PETALING JAYA | Some two million eligible contributors can now withdraw between RM9,000 and RM60,000 from Account 1 in the Employees Provident Fund (EPF) under i-Sinar.

They can start to withdraw the money from next month to help them deal with the Covid-19 pandemic economic fallout.

“After a thorough study and assessment, the EPF has taken the step to widen the scope of i-Sinar to cover active members who have lost their jobs, given no-pay leave, or have no other source of income, ” the fund said in a statement Monday (Nov 16).

The payout is expected to cost EPF about RM14bil.

Under the i-Sinar facility, eligible members will be able to start applying for withdrawals from December onwards, and the funds will be credited beginning January 2021.

“The first crediting will take place in January 2021. Advances will be made over a period of six months from the first date of crediting, ” EPF said.

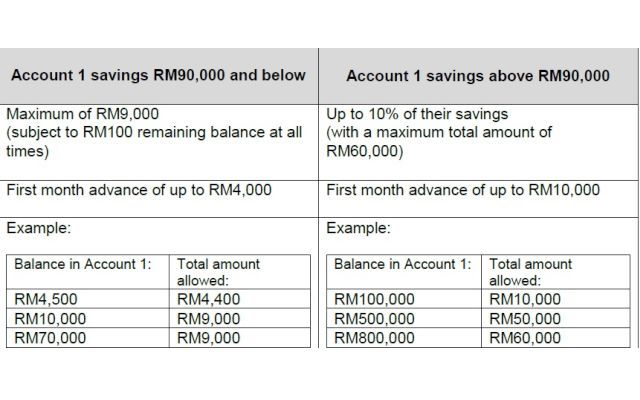

It said that those who have RM90,000 and below in their Account 1 will have access to any amount up to RM9,000, adding that the amount advanced will be staggered over a period of six months with an increased first advance of up to RM4,000.

It added that those who have above RM90,000 in Account 1 will have an access of up to 10% of their Account 1 savings.

However, it said the maximum total amount allowed to be advanced will only be RM60,000.

“The amount advanced will be staggered over a period of six months with an increased first advance of up to RM10,000, ” it said.

EPF noted that members who chose to apply for the i-Sinar facility will be required to replace the full amount.

“All future contributions will be 100% credited to Account 1 until such time the amount advanced is replenished.

Thereafter, contributions will revert to 70% to Account 1 and 30% to Account 2, ” it said.