KUALA LUMPUR | Faced with inadequate retirement savings and longer life expectancy, Malaysians will eventually have to work longer beyond the current retirement age of 60, according to the World Bank and the minister in charge of economic affairs.

The World Bank has called for the country’s minimum retirement age to be increased to 65, albeit gradually over the longer term

By increasing the retirement age to 65, Malaysia’s annual economic growth could increase by 0.3 percentage points.

“We are not recommending to raise the minimum retirement age from today to tomorrow, but perhaps over the next decade or even two decades, ” according to the World Bank’s practice leader for human development Achim Schmillen.

He said this at the launch of the “A Silver Lining: Productive and Inclusive Aging for Malaysia” report.

Concurring with the bank, Minister in the Prime Minister’s Department (Economic Affairs) Datuk Seri Mustapa Mohamed believes it is necessary for Malaysians to work longer in the future to ensure adequate financial protection in old age.

“As in nearly all high-income countries, longer working lives will in turn require gradual adjustments to the age when most Malaysians retire. In parallel, policies are needed that foster workers’ productive employment such as enhanced opportunities for training and lifelong learning, ” Mustapa said.

Such policies will allow Malaysians to work longer, be healthier for longer, with less physically demanding occupations, and with more digitally-enabled work places, he said in his keynote speech.

Interestingly, the World Bank report pointed out that there is no evidence the employment prospects of younger workers would be negatively affected due to increased employment among older people.

It added that talent shortages could be addressed if more Malaysians aged 50 to 64 are active on the labour market.

Come 2056, Malaysia will be a “super-aged society”, with over 20% of its population above the age of 65.

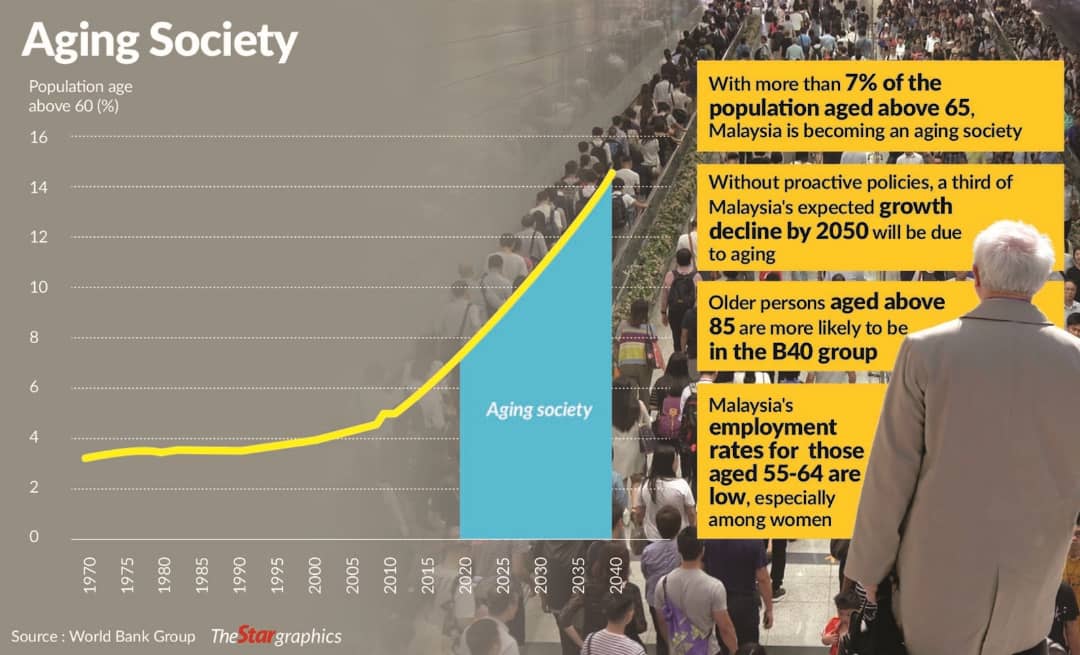

For perspective, Malaysia transitioned into an “ageing society” in 2020 as the size of the population aged above 65 was recorded at more than 7%.

It is noteworthy that the pace of ageing in Malaysia is nearly identical to Japan’s. Within the Asean region, Thailand, Singapore and Vietnam have become aging nations ahead of Malaysia.

Without proactive policies, the World Bank said Malaysia’s slower population growth and the shrinking relative size of the working-age population would account for a third of the decline in headline gross domestic product growth by 2050.

In view of the rising senior citizen population, the bank has urged the government to build an inclusive aged care system.

According to World Bank group representative to Malaysia and country manager Firas Raad, Malaysia has an opportunity to better protect its elderly citizens and enable them to age with dignity and purpose.

“The provision of minimum income protection for older Malaysians will require further improvements in the coverage and adequacy of social insurance schemes.

“A broadly targeted tax-financed social pension may also be required to comprehensively cover the population, ” he said.

In the short or medium term, the World Bank said one practical option would be to introduce a social pension of RM350 per month, targeted at the B40 group aged 65 and above and using the Bantuan Sara Hidup implementation system.

Other short-term measures to protect Malaysians post-retirement living standards would be by broadening EPF coverage to more self-employed and informal workers, improving quality standards of aged care homes, and enhancing opportunities for training and lifelong learning.

In the longer term, the World Bank calls for the need for longer working lives, which in turn will require gradual adjustments to the minimum retirement age and EPF’s minimum withdrawal age in line with increasing life expectancy.