HOW much should our workers be paid? This issue has long been debated by our lawmakers as well as our institutions, which include Bank Negara in its latest 2018 annual report and the highly respected Khazanah Research Institute (KRI).

According to Bank Negara, the labour share of income, despite having risen from 31.7% in 2010 to 35.2% of GDP in 2017, still lags behind most advanced economies, which implies that a larger fraction of national income in Malaysia goes to capital owners rather than workers.

KRI, on the other hand, says Malaysia’s low-wage environment has forced young job-seekers to be willing to work for as low as RM1,715 on average, or about 40% lower than 2017’s national mean monthly wage, and has called upon the government to urgently review wage levels, especially among young graduates as well as low-skilled workers.

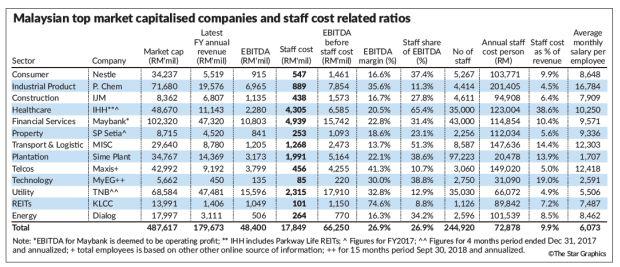

With the argument put forward by our institutions, an analysis among our listed companies tells us a mixed picture. The following analysis is made within the core sectors of Bursa Malaysia Main Market-listed companies, taking into consideration the fact that most of them have just released their 2018 annual reports. The top market-capitalised company in each sector is chosen to represent the industry, while the measurement of payment to their respective workers is solely based on salaries, wages and bonuses paid, and excludes contributions to provident funds, benefits made or provided for, as well as costs associated with share-based schemes, if any.

The key column in Table 1 (left) is the staff share of earnings before interest, tax, depreciation and amortisation (Ebitda), which demonstrates how much of the Ebitda earned by a company, before taking into consideration staff salaries, is actually paid to the employees in percentage terms. The figure on the number of staff is taken as per the annual reports, with the exception of Maxis Bhd

The second important column in Table 1 is the staff cost as a percentage of revenue, as well as the second-last column, which explains what percentage of revenue earned goes towards paying salaries and wages. The last column is a column for readers to appreciate – which companies pay their workers the best or worst monthly salaries on average, which is also an indication for potential employees to target which sector to concentrate on for their future employment.

Although just 13 companies are captured in this analysis, they represent 28% of the total market capitalisation of Bursa Malaysia, and out of the 13, eight are FBM KLCI-linked stocks. The other obvious observation from Table 1 is that the profitability level among different industries varies greatly from as high as almost a 75% Ebitda margin in the REITs sector to just 14% in the transportation and logistics segment.

For these 13 companies, for every RM1.00 earned, 27 sen goes to the salaries and wages of workers, which is even below the labour share of income envisaged by Bank Negara in its 2018 annual report, ie, assuming this is a comparable measurement.

Among the sectors, REITs has a very low share of salaries over the Ebitda earned, as the sector typically employs fewer people due to the nature of the industry, as most REITs actually provide management services for their assets. Staff cost as a percentage of Ebitda is high in sectors which are dependent on mass labour to generate revenue such as healthcare services, especially those related to the operations of hospitals like IHH Healthcare Bhd. MISC Bhd too has a relatively high percentage of staff cost, while those in the range of between 30%-40% are rather common, led by MyEG Services Bhd at 38.8%; Sime Darby Plantation Bhd (38.6%); Nestle (M) Bhd (37.4%); Dialog Group Bhd (34.2%) and Malayan Banking Bhd (31.4%).

On average, our top listed companies within the key sectors only pay about 10 sen for every RM1 they earn as revenue to their staff as wages. Worse still, some pay even less than five sen for every RM1, while for IHH Healthcare, the figure is relatively high mainly due to perhaps higher wages for medical staff that are employed across its hospitals.

Employees working for these top-13 companies typically earn, on average, a salary – together with bonuses paid – of about RM6,073 per person per month. However, the disparity between the sectors is rather high, with the highest being Petronas Chemicals Group Bhd at more than RM16,000 per month, while in Sime Darby Plantation Bhd, it’s just above RM1,700 – almost a 10 times difference between the companies and between two very different industries.

Prime Minister Tun Dr Mahathir Mohamad, in his keynote address at Invest Malaysia last month, called upon Malaysian companies to pay higher wages to employees, as he believes that we should not have “a thoroughly unequal society where capital owners take too much a chunk of national income, leaving the workers or low-income households with scraps”. The question is, what is a fair share of income for workers against what is earned by corporates? We can perhaps all agree (other than the employers that is) that 27 sen to the ringgit is not enough. Perhaps, a better reflection of income sharing is at least within the 35sen-40 sen range for every ringgit earned by our corporates at the Ebitda level.

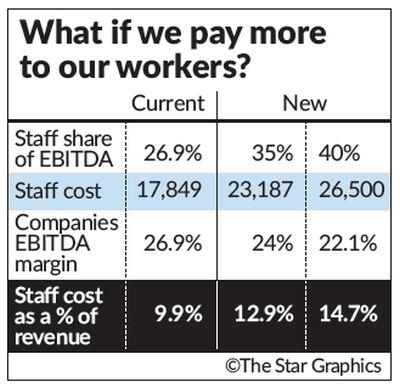

Assuming our corporates pay about 35% of Ebitda before the staff cost earned, what is the cost to them?

Effectively, an increase to 35%-40% of Ebitda being apportioned as staff cost will result in the current average salary per employed person per month to increase by 30% and 48% to RM7,889 and RM9,016, respectively. The impact to corporates on the Ebitda margin will not be significant in that the Ebitda margin will drop from 26.9% to 24% and 22.1%, respectively, while as a percentage of revenue, the companies’ staff cost will only increase by three percentage points to 12.9% if wages are 35% of Ebitda before staff cost and to 14.7% if the staff cost share of Ebitda is at 40%. Table 2 summarises the impact of a higher wage cost on companies’ Ebitda as well as a percentage of revenue.

Given the above analysis, shouldn’t salaried persons be paid higher wages? I am sure anyone reading this who is an employee will agree with me. Higher wages would lead to higher disposable income, while at the same time generating a higher GDP growth as well as top-line growth for companies. Hence, paying our employees higher wages is not a zero sum game, and indeed, should be encouraged to keep up with the cost of living, as well as to ensure our workers have the resources to enjoy the basic rights of living, especially having a roof over their heads.

©