SUNGAI BULOH | Starting next month, the Statistic Department will release the Salaries and Wages Report on a quarterly basis rather than an annual basis to address labor market issues.

According to the economy minister, Rafizi Ramli, this will allow employee to be more aware of labor market demands and to avoid underemployment.

This, according to him, would also help to keep the focus on salary-related issues, serve as a good benchmark to promote an open labor market, and provide enough data to build an efficient data infrastructure. “Otherwise, we cannot make evidence-based policies as we need more information and that’s what we’re working on.

“We are confident that the data infrastructure will be ready, and then we can talk about benchmarking,” he said after launching the Belanjawanku Guide and Mobile Application at the Employees Provident Fund (EPF) headquarters here yesterday.

Rafizi added that it would increase competition for talent on the job market.

“This move will help society and the economy as a whole as the labor market will be freer and more open.

“It will also make the labor market a more competitive marketplace for talents. Obviously, if employers continuously underpay their talents, they will face labor shortages as their workers leave.

“However, of course, we can’t leave it to the market alone. The government will be involved in terms of policies, incentives and frameworks.

According to employment groupings, age groups, and level of education, the report includes information on the number of people who are employed as well as the median wage.

“The data is already available. However, I will need to present it to the Cabinet first and wait for the chief statistician to return from haj as well,” Rafizi said.

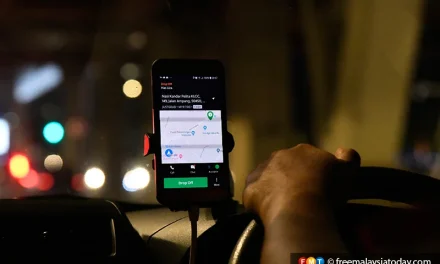

Earlier, he launched the Belanjawanku mobile application to enable users to track their expenses online.

For 11 cities around the nation, the guide outlines the bare minimum expenditures per household and offers suggestions for spending on needs, optional purchases, and personal savings.

According to Tan Sri Ahmad Badri Mohd Zahir, chairman of the EPF, “The data shows that 47% of Malaysian find it difficult to set aside RM1,000 for emergency use,” cited from the National Financial Literacy Strategy 2019-2023 by the Financial Education Network and the Financial Capability and Inclusion Demand Side Survey 2021 by Bank Negara Malaysia.

He said that the Belanjawanku guide is for Malaysian to become savvier in managing their finances.