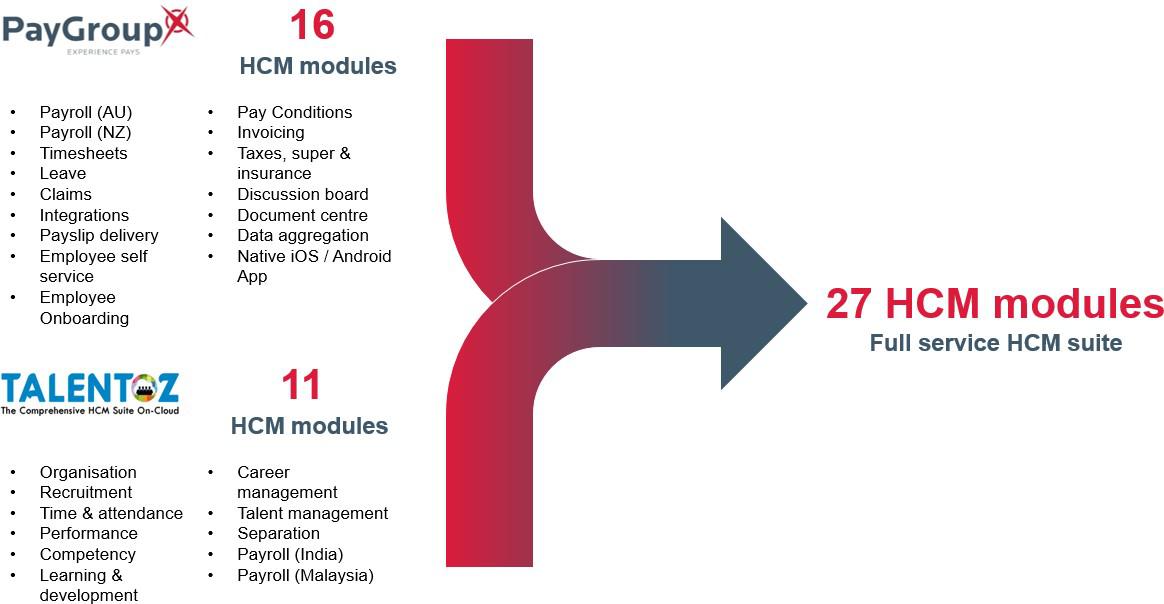

Executing expansion strategy to create a full service HCM suite

-

TalentOz is a leading SaaS HCM, analytics, and payroll provider headquartered in Malaysia

-

Compelling strategic rationale for the acquisition:

-

Creation of a comprehensive, full service HCM, analytics and payroll product suite

-

Adds 11 new SaaS HCM modules, broadening PayGroup’s SaaS offering to 27 modules

-

Strong and diversified book of 40 new clients

-

Addition of an in-house Asian-based technology development centre to complement

- PayGroup’s existing AU-based development team

-

-

-

Access to a proven management & sales team as well as new channel partners

-

PayGroup expects to realise significant technology cost synergies

-

-

Consideration of $1.2M, being 1.7x SaaS revenue

Melbourne | Human Capital Management SaaS and Software with a Service (SwaS) provider PayGroup Limited (“PayGroup”, “the Group”; ASX: PYG), today announced it has acquired 100% of the assets of the TalentOz Group of Companies (“TalentOz”) from SMRT Holdings (SMRT.KLSE) and a private shareholder.

The acquisition of TalentOz enables PayGroup to provide its clients a unique combination of SwaS and SaaS solutions covering the entire “Hire to Retire” employee lifecycle, across the 33 countries it currently operates in.

Commenting on the acquisition, PayGroup’s Managing Director, Mr Mark Samlal said, “TalentOz have an impressive management & sales team as well as channel partners, who have developed and commercialised a world class SaaS Human Capital Management (“HCM”) product suite. Through the acquisition of TalentOz, we are excited to add 11 more HCM modules, improve innovation and analytics for our existing 875 clients, and welcome 40 new clients. In addition, this acquisition adds a highly experienced in-house technology development centre in the Asian region, which will complement our existing Australian-based development team.

“PayGroup and TalentOz have been partnering to win new customer opportunities and are already seeing early success – a positive indication of the future potential for our combined product offering. TalentOz has established an impressive track record over the past few years and PayGroup is looking forward to working with their talented employee team.”

Overview of TalentOz

TalentOz provides comprehensive cloud-based HCM software with payroll modules for Malaysia and India. It has an innovative HCM, analytics and payroll product suite with leading end-user functionality, enabling businesses to unlock the full value of their workforce, across all devices.

TalentOz:

- has a strong and diversified book of 40 clients, with no single client accounting for more than 5% of its subscription fees;

- delivered revenue CAGR of 170% p.a. over the last 3 years, since the development of its SaaS module based platform; and

- is accessed by over 30,000 active users monthly, adding to PYG’s growth in SaaS revenues.

TalentOz is a comprehensive Human Resource Planning software developed and majority owned by publicly listed Malaysian investment company, SMRT Holdings. SMRT Holdings Executive Director Danny Chu Kheh Wee said, “This transaction represents an excellent synergistic opportunity for both PayGroup and TalentOz. The outlook for TalentOz is extremely positive, with significant market potential for the enlarged HCM SaaS product suite. TalentOz’ end-to-end solution is a differentiated product in the rapidly growing payroll and HR outsourcing market. We are very pleased to become shareholders in PayGroup and continue to share in the growth of the TalentOz business.”

Strategic rationale

The acquisition of TalentOz forms part of PayGroup’s expansion strategy to create a full service HCM product suite, and is underpinned by compelling strategic product and financial rationale.

TalentOz will add 11 new HCM modules that are highly complementary to PayGroup’s current SaaS offerings. The creation of a full service HCM product suite will be a highly attractive proposition for PayGroup’s customer base in all geographies. The 11 new HCM modules are strategically aligned with PayGroup’s all-in-one HCM SaaS strategic product focus and bring greater capabilities across all devices in the areas of analytics, competency, talent management, time and attendance, performance measurement, learning and development, career management, recruitment and onboarding. PayGroup’s enlarged HCM product suite will comprise the 27 HCM modules detailed below:

The acquisition of TalentOz comes at a time of unprecedented disruption around the globe, with significant changes in the way businesses operate, further increasing complexity in managing workforces. This presents significant opportunities for PayGroup to work with its customers to offer comprehensive HCM and payroll SaaS & SwaS solutions, delivering improved outcomes and efficiencies.

TalentOz also has an in-house development team as well as a proprietary payroll solution for use in Malaysia and India. The addition of an in-house development team based in the Asian-region will complement PayGroup’s AU-based development team and ensure the provision of superior quality and tailored service provision for PayGroup clients. Additionally, TalentOz’ proprietary payroll solution is expected to generate significant savings for PayGroup in these markets, enabling the transition away from the Group’s third-party technology provider.

Acquisition terms and the appointment of Corporate Advisor

Following a comprehensive due diligence process, PayGroup has acquired 100% of the assets of the TalentOz business for consideration of SG$1.15M (A$1.2M). A further SG$500K (A$520K) is payable in twelve months in shares (“Earn-Out”), subject to the achievement of certain performance criteria.

The initial consideration implies an acquisition multiple of 1.7x SaaS revenue.

Payment of the acquisition consideration was comprised of SG$165K cash and the issue of SG$985K of PayGroup shares ( 1,211,759 shares issued at A$0.84 per share). Shares issued to the vendors of TalentOz are subject to an escrow period of 12 months. Paygroup has also issued 615,106 shares at $0.84 per share comprising the Earn Out to an escrow agent.

PayGroup is also pleased to announce it has appointed Canaccord Genuity (Australia) Ltd (“Canaccord”) as its corporate advisor. Canaccord will assist with the Company’s ongoing capital markets strategy, provide introductions to a broader investor community both domestically and internationally as well as provide other advisory services.